December 2019

It’s still early days. Stocks and shares needs to make up a significant proportion of my investments so I have been investigating investment brokers. The platform I have decided to use is FreeTrade, a new platform with no trading fees. Investments won’t start until next month

Investments

This months investments are on the same theme as last month. The Sun Exchange investment amounted to £742. My second investment of £500 to Crowd Property doubles my investment in property development. My regular investment of £200 to Invictus Capital and £77 of TUSD to NEXO completes the investments.

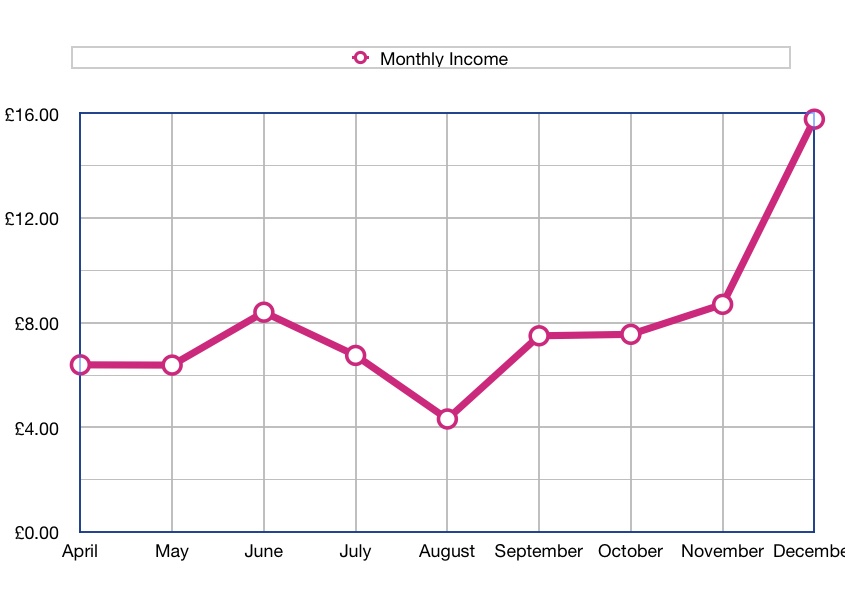

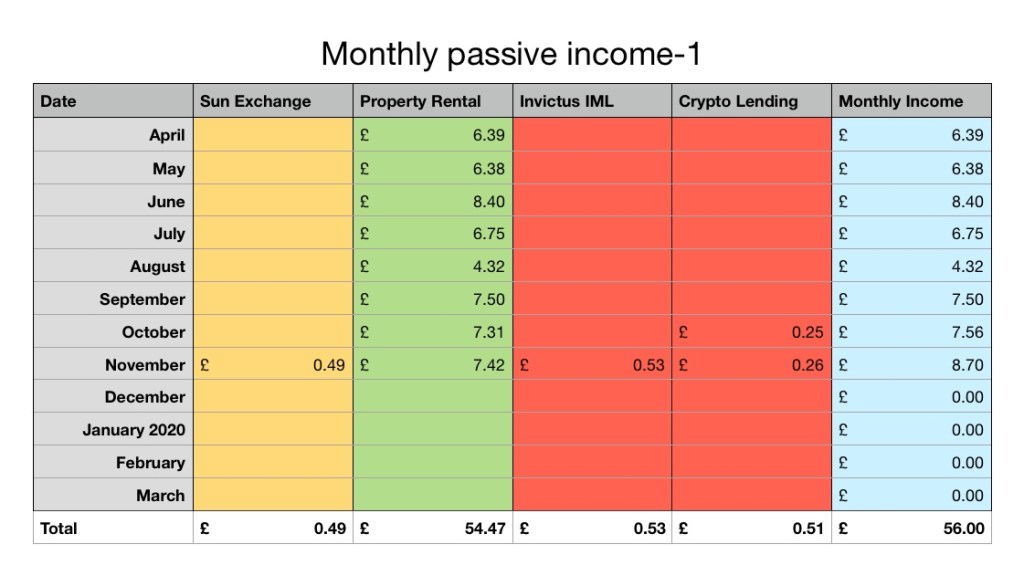

Monthly Income

Income from The Sun Exchange from the first project has started to come in. Some of the development loans pay back monthly, so a small amount of income has started to come in from Crowd Property. In the crypto sphere, the Invictus fund has started to grow and interest is starting to come in from NEXO.